Reality Check: The Truth About DeFi Investor Trends (- WTF Happened?!)

Solana's 2025: A Data Analyst's Reality Check

The Solana network: it’s fast, it’s cheap, and it’s been relentlessly hyped. But what does the data actually say about its performance in 2025? Let's cut through the noise and look at the cold, hard numbers, shall we?

Solana's Performance Metrics

Solana boasts impressive throughput, claiming 1,000+ transactions per second (TPS). The report states near-constant uptime. Digging deeper, the average TPS is closer to 1,100. That uptime figure clocks in at about 99.9% over 16 months. Not bad, but those "minor interruptions," typically during software updates or stress periods, are worth noting. Are these just growing pains, or a sign of deeper instability?

Decentralization Concerns

The network metrics paint a generally positive picture, but there are discrepancies. Active validators number 1,295, which the report calls "moderate decentralization." Yet, it also concedes that "concentrated stakes could pose governance risks." That's analyst-speak for: a few big players control a lot of the network. The Nakamoto Coefficient, a measure of decentralization, is 20. This is comparable to other top Layer-1 blockchains, but it’s hardly a gold standard of distributed governance. Is Solana really as decentralized as its proponents claim?

Hardware Requirements and Validator Concentration

And this is the part of the report that I find genuinely puzzling. Solana's architecture, combining Proof of History (PoH) and Proof of Stake (PoS), is supposed to be a strength. PoH is a cryptographic timestamping system, and PoS secures consensus through token staking. Yet, all this speed and supposed efficiency comes at a cost: elevated hardware requirements. Multi-core CPUs, large memory, and high disk I/O are not cheap. This raises the barrier to entry for validators, contributing to validator concentration among well-capitalized operators. Doesn’t this directly contradict the ideal of a decentralized, permissionless network?

SOL Token Utility and Distribution

The report highlights that SOL primarily functions as a utility token for transaction fees and staking, not as a speculative instrument alone. Transaction fees are indeed low, around $0.00025 per transaction. Staking yields are also attractive, hovering around 6-7% annually. But let's be honest: a significant portion of SOL's demand is driven by speculation. The token distribution is also worth a closer look. Founders & Team hold 16.23%, and Early Investors control 10.46%. That's over 26% of the supply in the hands of insiders. While the vesting schedules are supposed to mitigate immediate market pressure, it still creates a power imbalance.

DeFi and NFT Ecosystem Analysis

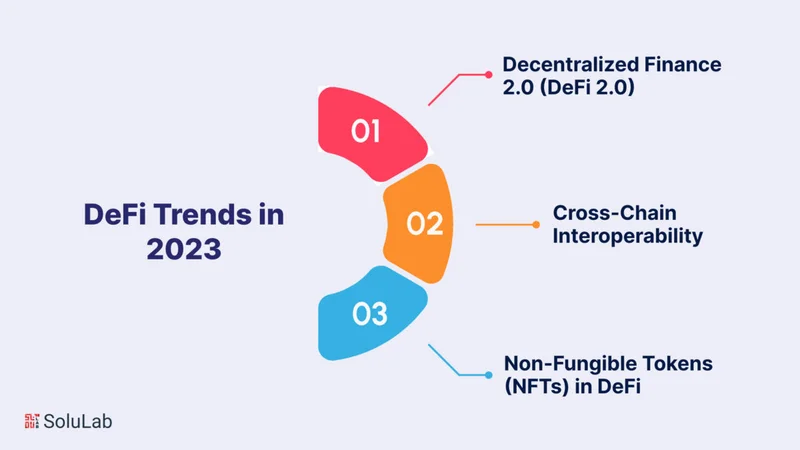

Solana's DeFi ecosystem has a Total Value Locked (TVL) of $5.1 billion, while NFTs account for $1.2 billion. High TVL in DeFi suggests strong activity, and NFTs demonstrate Solana's ability to handle high-demand applications. But how much of this activity is organic, and how much is driven by incentives and subsidies? What happens when those incentives dry up? DeFi Token Performance & Investor Trends Post-October Crash

Correlation with Bitcoin and Ethereum

The elephant in the room is Solana's correlation with Bitcoin and Ethereum. The report puts the correlation at 0.72 and 0.68, respectively. This means that Solana's price is heavily influenced by broader market trends, regardless of its network fundamentals. In other words, Solana is still riding the crypto wave, and when that wave crashes, SOL will likely crash with it.

Solana Price Outlook 2025-2030

The Solana Price Outlook for 2025-2030 is cautiously optimistic. The base case for 2025 is $135-$160, based on sustained TPS, staking adoption, and moderate macro stability. The stress case is $110-$135, reflecting a market-wide crypto downturn or temporary regulatory uncertainty. Those are pretty wide ranges if you ask me. It all depends on external factors that are difficult to predict. Solana Price Prediction: Is Solana a Good Investment?

A Qualified "Maybe"

Solana has made impressive strides in terms of throughput and cost. However, questions remain about its decentralization, its reliance on speculation, and its vulnerability to broader market trends. The data suggests that Solana is not a slam-dunk investment. The data is there, but the interpretation is what matters. A good investment? Maybe. A revolutionary technology? The jury is still out.

Previous Post:The Bitcoin Contradiction: Price Drops, Interest Soars (r/Crypto)

No newer articles...

Related Articles

Plasma: What It Is, How It Saves Lives, and What Comes Next

The night sky over Wyoming split open. It wasn’t the familiar, ghostly dance of the aurora that Andr...

The Aster DEX Breakthrough: What It Is and Why It’s a Glimpse Into DeFi’s Future

A number gets thrown around in technology that is so large it almost loses its meaning: a trillion....

Pudgy Penguins: The Price Hype and What We Actually Know

So, everyone’s losing their minds over whether the Pudgy Penguins crypto token, PENGU, can "defend"...

PIVX: Live Price Chart, Market Cap... Who Cares?

PIVX: Another Coin, Another Day, Another Headache? So, PIVX, huh? Never heard of it. I'm supposed to...

Bitcoin Hyper: Why It's Primed to Redefine Our Future

The Dawn of a New Digital Age: Why 2025 Isn’t Just Another Crypto Rally We’ve all seen it, haven’t w...

Monero's Privacy Push: What's Driving the Price Surge and Why Should I Care?

Crypto's "Privacy Revival"? More Like a Desperate Grasp at Relevance So, the narrative now is that p...