Baba Stock: The Price Reality

Alibaba's Latest Plunge: Who's Really Surprised by This Whole Military Mess?

Another Day, Another Chinese Tech "Scandal"

Alright, folks, let's cut the crap. You saw the headlines, right? `Alibaba stock` — or `BABA stock price`, for those of you who track this stuff like a hawk — took a nosedive, shedding almost 5% in a single day. Why? Because a declassified White House memo apparently spilled the beans: Alibaba dips after White House memo claims it's helping Chinese military target US: report (BABA:NYSE) - Seeking Alpha Alibaba's been cozying up with the Chinese military, handing over customer data, IP addresses, payment records, the whole nine yards. They even allegedly gave the People’s Liberation Army access to their fancy AI tech.

Now, I gotta ask: Is anyone actually surprised? Seriously, raise your hand if you thought a massive Chinese tech company, operating under the ever-watchful eye of Beijing, wasn't sharing data with its government. Give me a break. It's like being shocked that a fish can swim. This ain't some innocent startup in Silicon Valley, dreaming of disrupting the world with free-range kombucha. This is Alibaba, a behemoth that lives and breathes in a country where the line between "private enterprise" and "state apparatus" is blurrier than my vision after a late-night debate on crypto.

They denied it, offcourse. "False information," "leaked to malign the company," they declared. And honestly, what else are they gonna say? "Yep, you caught us! Here's your IP address, comrade!" It's a dance as old as time, a performance we've seen on repeat with every major Chinese tech player. This isn't a bug in the system; it's the core feature. You invest in `alibaba stock`, you're not just buying a piece of an e-commerce giant; you're buying into a system where the government always gets its cut, one way or another.

The Numbers Don't Lie, But We Still Pretend

Let's talk brass tacks, because while the political drama is entertaining, the real pain is in the wallet. The `baba stock price` has been a bit of a rollercoaster, sure, up nearly 80% year-to-date, which is impressive on paper. But even before this latest bombshell, it was already trailing the `S&P 500` and its own `Retail-Wholesale sector` over the preceding month. That's a red flag waving in a hurricane, folks.

And then there are the projections. Analysts are bracing for an `EPS` of $0.66 for the upcoming earnings, a gut-wrenching 69.3% drop from last year. Revenue? A paltry 2.17% bump. Full-year estimates aren't much prettier, with earnings down over 27% and revenue up just under 5%. You don't need to be a rocket scientist — or even an `nvidia stock` or `tesla stock` investor who actually understands tech — to see those numbers are heading south.

Here's the kicker: Alibaba's got a `Zacks Rank` of #5, which, for the uninitiated, means "Strong Sell." Zacks isn't some fly-by-night operation; their #1 ranked stocks have returned an average of 25% annually since '88. So when they slap a #5 on something, it's not a suggestion; it's a warning flare. We're talking a `Forward P/E` of 25.24, sitting higher than its industry average of 21.83. And a PEG ratio of 1.99, while the `Internet - Commerce industry` averages 1.5. What does that tell you? You're paying a premium for a company that's underperforming its peers and is now embroiled in a national security nightmare. It's like buying a fixer-upper with a known termite problem and a leaky roof, then wondering why the value keeps dropping.

The Real Cost of Doing Business in China

This whole episode with `alibaba stock` isn't just about a single company or a dip in its `market capitalization`. It's a stark reminder of the fundamental risks baked into every Chinese investment. We can talk about market access, growth potential, and billions of consumers all day long, but at the end of the day, these companies operate under a different set of rules. Rules that prioritize state control over shareholder value, national security (as defined by Beijing) over corporate independence.

Are we really so naive to think that a company like Alibaba, born and bred in a surveillance state, could ever truly be independent? That its vast troves of data wouldn't be accessible to the government whenever it pleased? This isn't just about a declassified memo; it's about connecting the dots that have been staring us in the face for years. The "Great Firewall" isn't just about blocking Google; it's about controlling information, and by extension, controlling companies and their data.

So, when analysts tell traders to "be cautious," it's probably the understatement of the year. Cautious? My grandma's more cautious crossing the street than some investors are with these Chinese tech plays. The question isn't whether more of these allegations will surface; it's how many more times we're going to pretend to be shocked when they do.

The Elephant in the Server Room

Related Articles

Immaculata's Open House: A Data-Driven Breakdown for Prospective Students

On the surface, the announcement is unremarkable. Immaculata University, a private institution nestl...

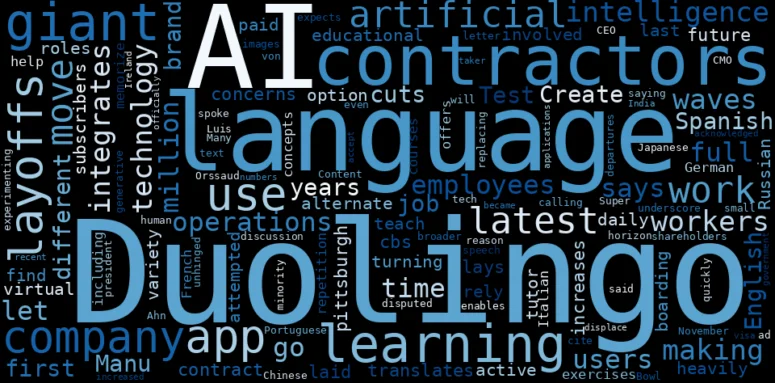

Duolingo Stock Plunge: User Growth vs. Investor Panic – What Reddit is Saying

Duolingo's Dip? More Like a Launchpad to Linguistic Domination! Okay, folks, let's talk about Duolin...

ABAT's Stock Surge: Separating the News from the Financial Reality

The market loves a good story, and American Battery Technology Company (NASDAQ: ABAT) just delivered...

US Government Backs Trilogy Metals (TMQ): Why It's Soaring and What It Signals for America's Future

I just read a press release that, on the surface, is about a mining company in Alaska. And I can’t s...

Rigetti Computing (RGTI) Secures $5.7M Quantum Order: Dissecting the Bull Case After its 9.6% Jump

Decoding Rigetti's Quantum Leap: Is a $5.7M Sale Worth a 25% Stock Pop? The news, when it hit the wi...

PGE's Landmark Solar Investment: What It Means for Europe's Green Future

Why a Small Polish Solar Project is a Glimpse of Our Real Energy Future You probably scrolled right...